Written by Peter Maddox, President of the Direct Sellers Association of Canada. Peter has extensive experience in the association world and the marketing industry. Over his career, he has managed government relations, regulatory affairs, member engagement, communications and business development. Originally from Australia, Peter has an MBA from Chifley Business School and a Marketing Degree from the University of Tasmania.

Written by Peter Maddox, President of the Direct Sellers Association of Canada. Peter has extensive experience in the association world and the marketing industry. Over his career, he has managed government relations, regulatory affairs, member engagement, communications and business development. Originally from Australia, Peter has an MBA from Chifley Business School and a Marketing Degree from the University of Tasmania.

Canada Remains Steady in a Sea of Uncertainty

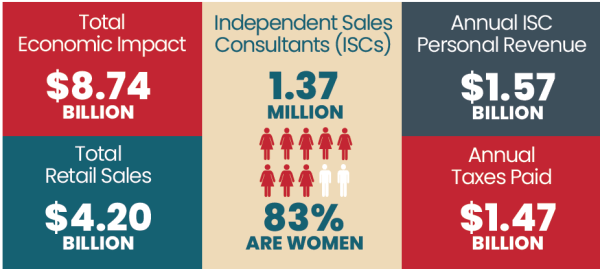

The Direct Sellers Association of Canada (DSA Canada) recently released the results of its 2022 Socio-Economic Impact Study (SEIS), which looks at both the macroeconomic impact of the direct selling industry across the country, as well as important social drivers that create success for individual companies and independent sales consultants (ISCs).

Conducted every three years, and verified with independent oversight from Nathan Associates, the study is based on 2021 direct selling company data and information collected in 2022 from ISCs.

The study helps to show that Canada remains a vibrant marketplace, one blessed with strong consumer confidence and business stability. Despite the unexpected turmoil of the past few years, 2021 sales in the channel have remained steady when compared to 2020, and all things considered, ISC numbers have held up well. With this in mind, it is going to be very interesting to see where these numbers go in the next couple of years, as economic pressures such as inflation, low unemployment, high-interest rates, etc., come into play.

Through conversations with direct selling companies operating in Canada, as well as respected industry watchers, it is clear they remain confident that this channel and country will ride the waves better than many others, despite current economic uncertainty.

Now, to the numbers.

Net Sales

Across the entire industry, total Canadian net sales in 2021 for all direct selling companies came in at $4.20 billion; which was slightly higher than the $4.15 billion reported in 2020, and 33% higher than $3.5 billion in 2018. Additionally, the average net sales of a direct selling company in Canada in 2021 was just over $28 million.

Although net sales figures for the two COVID years (2020 and 2021) grew incrementally by 1.2%, it is important to note that they were significantly stronger than previous years, for reasons that have been discussed ad infinitum – including a move to shopping from home, consumers investing in health-related products and ISCs committing more time to their businesses.

When exploring how sales were procured, the 2022 survey also provided insights into the following:

- Preferred Customers

- In 2021, 52% of companies surveyed offered a preferred customer program. For these companies, sales made via this program constituted 36.7% of their total net sales.

- On average, individual companies with a preferred customer program in Canada had 27,085 customers participating in their program.

- Looking back to responses from the 2019 and 2016 surveys, preferred customer programs continue to hold steady, with limited participant or sales growth. They appear to be plateauing.

- Autoship Programs

- 62% of companies surveyed had an Autoship program. Out of these companies, 24.2% of their 2021 net sales were generated through this program.

- Total Customers

- On average, surveyed companies reported having 101,727 total individual customers in the Canadian market.

Independent Sales Consultants (ISCs)

There were a total 1.37 million active ISCs in Canada, up from 1.16 million in 2018, but down ever so slightly from 1.38 million in 2020. Out of the 2021 figure, 83% were women.

- Geography

- As in previous studies, the percentage of total ISCs in each of Canada’s provinces and territories matched closely with the percentage of the total population in each region. Ontario, Quebec and British Columbia remain the provinces with the highest number of participants.

- Time Spent on the Opportunity

- In 2021, 7% of ISCs surveyed considered themselves to be working full-time on the opportunity, meaning they spent 30+ hours a week on their direct selling business.

- 27% spent less than 5 hours a week on their business, while the remaining 66% committed 5-30 hours weekly to direct selling.

- Top Skills

- Surveyed ISCs stated that the top three skills they had learned through direct selling were: (1) self-esteem and confidence, (2) social media and digital skills, and (3) sales and marketing skills.

Economic Impacts and Contributions of Direct Sales

An important part of the study, particularly as a tool for government and media outreach, is the calculation of how direct selling contributes to the prosperity of the overall Canadian economy. Evidence of the industry’s strength and importance to the Canadian economy provides positive content to be shared by DSA Canada and its member companies when advocating for the industry.

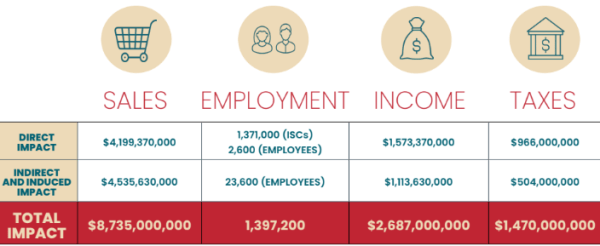

What do we mean by economic impact? It is the overall financial effect of salaries, commissions and spending that are a result of the activities of direct selling companies and ISCs, and the businesses they interact with economically.

- The total economic impact of direct selling in Canada in 2021, including direct, indirect and induced effects, was $8.735 billion.

- A key part of this was the total commissions paid out to ISCs in Canada, which stood at $1.57 billion.

- Furthermore, the estimated total 2021 taxes paid in Canada as a result of direct selling activity was $1.47 billion.

Through the economic and tax activity it creates, the direct selling industry contributes to societal investments in education, health care and other crucial infrastructure initiatives. These contributions are an important aspect of the industry, which is often overlooked but should be highlighted and communicated to all Canadians.

Use of the Report

As part of its ongoing meetings with government officials from across the country, DSA Canada is utilizing this report to provide education on the industry and to promote its advocacy goals. Likewise, members are encouraged to meet with local officials to talk about their impact on the community.

As part of their DSA Canada membership, member companies have access to further data and insights from the Socio-Economic Impact Study, beyond that which is available to the public. Many are choosing to use this demographic and economic data to assist with their strategic planning for the Canadian market.

What’s Ahead?

While there are challenges in 2022, and more on the horizon, the fundamentals of Canadian direct selling remain strong. Regulatory certainty, strong relationships between DSA Canada and key external stakeholders, and positive consumer confidence indicators point to a relatively soft landing for business in 2023.

As always, direct selling is an industry that favors companies with great products, a compelling entrepreneurial opportunity and deep relationships with the communities they serve. Companies with these traits and a strong commitment to Canada will continue to thrive in this market.

The DSA Canada Socio-Economic Impact Study report can be viewed here.

SHARE THIS ARTICLE: