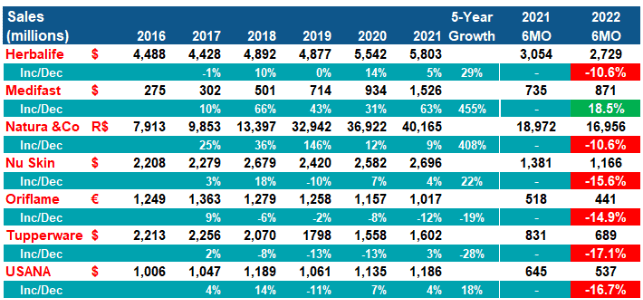

Direct selling industry had not made a great start to 2022. The review of seven major direct sales companies’ reports indicate external challenges the industry has been facing continued in the second quarter, too. Challenges the businesses had to deal in Q2 were twofold: Those that are pandemic-related and the war in Europe.

Again, this review covers Herbalife, Medifast, Natura &Co, Nu Skin, Oriflame, Tupperware and USANA’s global results.

Herbalife’s second quarter 2022 net sales was $1.4 billion, a 10.3% decrease compared to the second quarter 2021.

This result was above the expectations so John Agwunobi, Chairman and CEO of Herbalife was happy and said, “We are pleased to announce our Q2 performance exceeded our guidance on both top and bottom lines, and we continue to project a return to net sales growth in the fourth quarter.”

As far as the regional performances are concerned, Mexico (+4%) and Asia-Pacific (+15%) posted increased sales. Sales in South & Central America declined by 6%, in North America by 17%, in EMEA 21%, and in China by 41%.

During the month of July, the company hosted two large sales events in the U.S. and India, with combined in-person attendance of over 40,000. Herbalife reported it had approximately 60 new SKU launches during the second quarter, and more than 20 so far during Q3..

Herbalife announced John DeSimone’s becoming the Executive Vice Chair of the company. Additionally, Herbaife has created three new regional presidents: Stephen Conchie will be Regional President of APAC and China, Edi Hienrich will be Regional President of EMEA and India, and Frank Lamberti will be Regional President of the Americas.

In early August, the company announced “Herbalife One”, a new digital transformation initiative. It is labeled as “the future of Herbalife’s digital technology” and has been designed to boost distributor growth and elevate customer experiences. Herbalife One will be company’s first-ever unified data and AI-powered global digital platform. Management projected to invest approximately $400 million in this program.

For 2022, management expects an annual sales decrease of 4% to 10%. Herbalife’s first six-month revenue in 2022 is down 10% from last year.

For more on Herbalife’s second quarter performance, please click here.

Medifast continued its growth in the second quarter, too, with its revenue increasing 15% to $453.3 million. The company also reported 14.9% growth in its number of independent active earning OPTAVIA coaches to 68,000.

“We delivered another solid quarter at Medifast,” said Dan Chard, Chairman and CEO. “We’re not immune to issues in the wider macroeconomic environment, and like many consumer-focused businesses, we’ve seen the impact of inflation on customer retention and consumer sentiment, which will cause slower-than-anticipated growth in the second half. However, we believe we remain well-positioned for significant future growth as we continue to execute our core strategies and expand further into the broader health and wellness arena.”

Management said in the latter part of the quarter, they saw some moderation in the customer retention curves. This impacted Medifast’s growth trends and revenue outlook for the year. To mitigate the impact, the company launches of a bonus program to promote new coach sponsoring and client acquisition. Management believes this initiative will be beneficial to customer retention as they move through the year.

Medifast announced its full-year 2022 revenue expectation as $1.58 billion-$1.66 billion, down from the previously announced range of $1.78 billion to $1.84 billion.

For more on Medifast’s second quarter performance, please click here.

The company reported R$8.7 billion (approx. US$ 1.7 billion) consolidated revenue in the second quarter, -8.6% compared to Q2 of 2021. As of mid-year, Natura &Co’s sales growth is -11% versus last year.

Fabio Barbosa, Group CEO of Natura &Co, said, “Natura &Co’s second quarter results reflect the difficult environment in which we are operating, marked by high inflation that is pressuring consumer spending, supply chain disruption and continuing macro-economic and geopolitical uncertainty. But they also reflect structural issues within our group that we have clearly identified and have started to address.”

He also said, he had been focusing on two priorities: 1) Redesigning Natura &Co’s organizational structure to make it lighter and leaner, and 2) A review of the governance model and ways of working within the group, with the holding company strongly concentrating on defining key performance indicators, monitoring and tracking the performance of more autonomous brands.

Looking at the performances of business units, we see Natura &Co Latam’s Q2 net revenue was up by +0.4% in BRL. This result was driven by Natura’s double-digit growth (+12.2%) that was partially offset by a decline (-12.8%) in the Avon brand. Avon Latam’s decline was caused by a drop of -31% in fashion and home category’s sales.

Avon International’s revenue was down -25.4% in BRL, mainly impacted by the war in Ukraine, low consumer confidence, and eroding household purchasing power in Europe as well as fewer representatives in Europe.

The Body Shop’s Q2 sales declined -25.3%. Management said the reason to this was the post-lockdown channel rebalancing, as the decrease in sales at The Body Shop At Home and e-commerce outpaced the progressive retail recovery. The Body Shop’s store revenues were up versus last year.

Natura &Co’s fourth business unit Aesop reported 5.7% sales increase in the second quarter. All regions of Aesop delivered double-digit growth, led by North America and APAC.

For more on Natura &Co’s second quarter performance, please click here.

Nu Skin’s global sales in the second quarter were $561 million, down 20% from Q2 of 2021.

President and CEO Ryan Napierski said, “As previously announced, our second quarter results were impacted by extended COVID-related factors in Mainland China, distractions in EMEA related to the ongoing conflict, weaker global economic conditions impacting emerging markets and the record strength of the U.S. dollar. Despite these challenges, we delivered our ninth consecutive quarter of growth in the U.S. on the strength of new product launches and our social commerce model. Additionally, we drove year-over-year growth in our Southeast Asia/Pacific and Hong Kong/Taiwan segments.”

Among the regions, Southeast Asia/Pacific (+12%) and Hong Kong/Taiwan (+2%) grew but all others reported sales decreases: Americas -10%, Japan -18%, South Korea -22%, EMEA -39%, Mainland China -44%.

The company said Mainland China continued to be very challenged with the lockdowns impacting business momentum negatively for several quarters. China accounts for about 1/5 of company’s global business.

For the third quarter of 2022, management expects a sales decline of between 8% to 13%. For the whole year, the forecast is $2.33 to $2.41 billion revenue (11% to 14% decrease vs. 2021)

For more on Nu Skin’s second quarter performance, please click here.

Oriflame’s global revenue declined in Q2 for the sixth consecutive quarter since the beginning of 2021. Reported sales were EUR 211 million and this was 14% below last year same quarter’s figure.

“Different from previous quarter, we now saw the full quarterly impact of the war on our business. This was further fueled by the continued negative impact from the Covid-19 situation and lockdowns in China, as well as slower return to normalized business in Indonesia and some other markets,” commented CEO Magnus Brännström. “To increase our focus on regaining sales momentum and overall profitability, we have announced a new customer-centric organization supported by an updated brand-oriented growth strategy and led by a new Group Management team.”

In Latin America, company’s sales decreased by 10% in the second quarter. The decrease was 13% in Turkey & Africa, and 16% in Europe & CIS (“Commonwealth of Independent States”) and also in Asia. Management said the war had a negative impact not only in Russia and Ukraine’s figures, but also in several neighbouring countries’ in CIS and Eastern Europe.

In Latin America, company’s sales decreased by 10% in the second quarter. The decrease was 13% in Turkey & Africa, and 16% in Europe & CIS (“Commonwealth of Independent States”) and also in Asia. Management said the war had a negative impact not only in Russia and Ukraine’s figures, but also in several neighbouring countries’ in CIS and Eastern Europe.

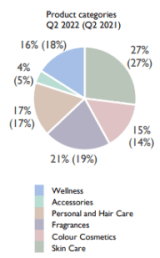

In the second quarter, Oriflame’s product categories remained quite stable: Skin care 27%, fragrances 21%, personal & hair care 17%, wellness 16%, colour cosmetics 15%, and accessories 4%.

For more on Oriflame’s second quarter performance, please click here.

Tupperware’s second quarter sales were $340 million, representing a decrease of 18% year over year.

Company said this decrease was driven primarily by lower activity on the field, lockdowns in China, and lower consumer sentiment in Europe, along with along with the business model changes in the U.S. and Canada. In the U.S. and Canada, Tupperware made drastic changes to its business model, and it increased prices 10% in each quarter. This was the first time they took pricing actions in quite some time, management said.

This general negativity was partially offset by the strength in South America, driven by recruitment and retention efforts.

In fact, South America was the only Tupperware region that reported sales growth (+12%). Sales declined in North America by 14%, in Asia by 16%, and in Europe by 30%.

CEO of Tupperware Miguel Fernandez said, “During the quarter, we continued to address the operating factors within our control, specifically technology, operations, service levels, and ongoing implementation of global direct selling practices. While we are beginning to see encouraging trends in certain markets as a result of these efforts, more work remains to optimize our operations and supply chain. We nevertheless remain on track to further penetrate retail channels later this year, which we believe will be a milestone in our omnichannel evolution, and provide a needed catalyst for long-term growth.”

For more on Tupperware’s second quarter performance, please click here.

USANA reported 21% decline in sales in the second quarter compared to the same period of 2021 ($264 million vs. $337 million). The number of company’s active customers also dropped by 14%.

“Although many of the disruptions were outside of our control, and while we faced a tough year-over year comparable due to the timing of a successful sales program in 2021, our second quarter results were not up to our standards. Nevertheless, we remain committed to our business strategy which we believe will deliver sustained, long-term growth in customer counts, net sales, and EPS,” commented CEO Kevin Guest.

All of USANA’s regions came up with revenue decreases in Q2: Greater China -15%, Americas and Europe -19%, North Asia -23%, and Southeast Asia Pacific -37%. Greater China remained as the largest region with its over 50% share in company’s total sales.

The company is anticipates net sales of $1.015 – $1.065 billion in 2022. This represents a decline of 10% to 14% from 2021. Currently, USANA’s 2022 first half revenue is 17% below last year’s.

USANA is celebrating its 30th anniversary this month at its global convention in Salt Lake City, Utah.

For more on USANA’s second quarter performance, please click here.

…..

Hakki Ozmorali is the Founder of WDS Consultancy, a management consulting and online publishing firm in Canada, specialized in providing services to direct selling firms. WDS Consultancy is the publisher of The World of Direct Selling, global industry’s leading weekly online publication since 2010. Hakki is an experienced professional with a strong background in direct sales. His work experiences in direct selling include Country and Regional Manager roles at various multinationals. You can contact Hakki here.

Hakki Ozmorali is the Founder of WDS Consultancy, a management consulting and online publishing firm in Canada, specialized in providing services to direct selling firms. WDS Consultancy is the publisher of The World of Direct Selling, global industry’s leading weekly online publication since 2010. Hakki is an experienced professional with a strong background in direct sales. His work experiences in direct selling include Country and Regional Manager roles at various multinationals. You can contact Hakki here.

SHARE THIS ARTICLE:

Leave a Reply